In the fast-paced world of business, it is not uncommon for B2B companies to face financial challenges and accumulate debts. However, ignoring these debts can have severe consequences that can negatively impact the success and growth of your business. TInvoiceGuard aims to shed light on the repercussions of neglecting debt and the importance of taking quick action in debt management for B2B businesses.

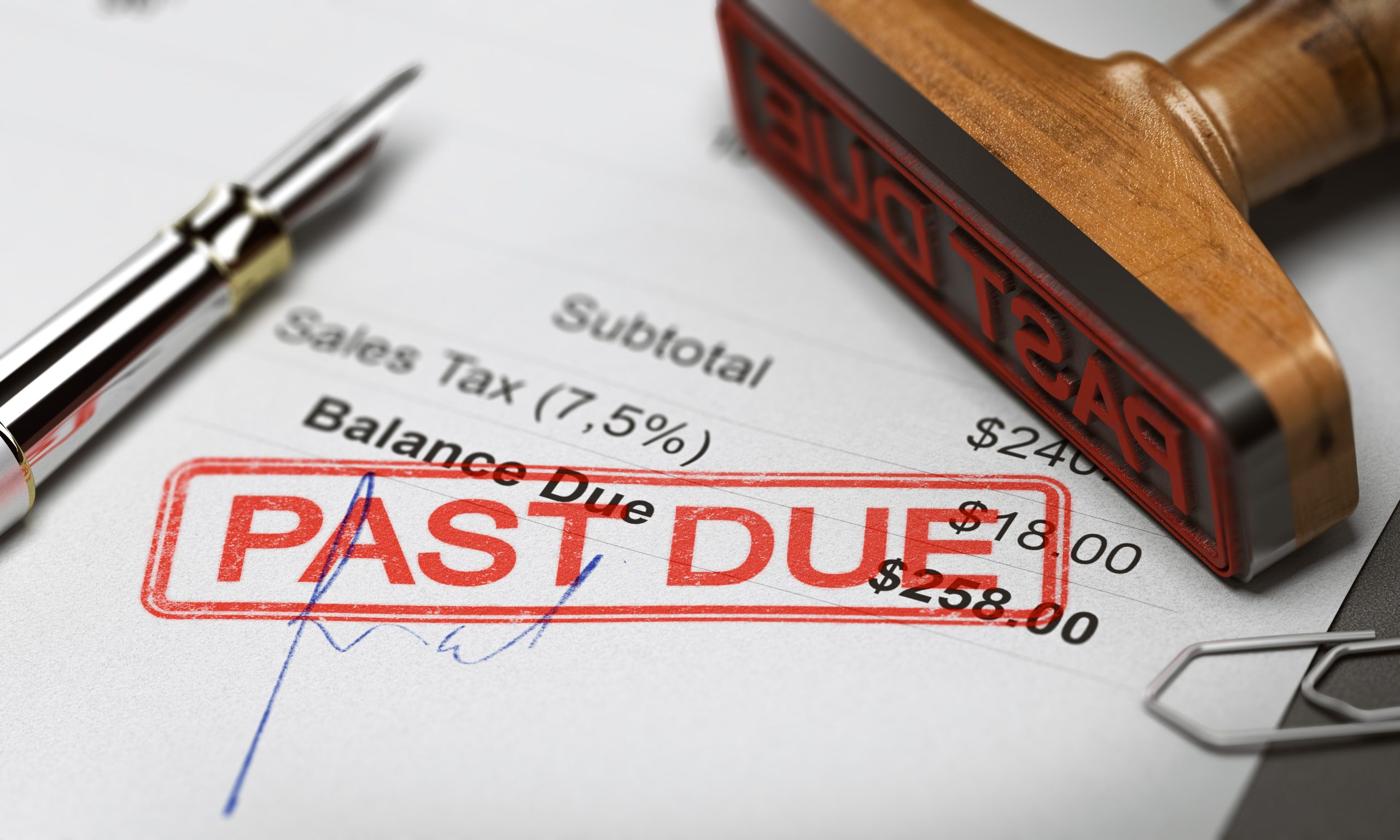

One of the most significant consequences of ignoring debt is the strain it puts on your company’s cash flow. When debts remain unpaid, it can become increasingly difficult to meet your financial obligations, such as paying suppliers, employees, or even covering day-to-day expenses. This can lead to a vicious cycle of late payments, penalties, and damaged relationships with creditors and suppliers, which can ultimately harm your business’s reputation.

Furthermore, ignoring debt can also lead to a decrease in your creditworthiness. Late or missed payments can result in a lower credit score, making it harder for your business to secure loans or credit in the future. This can hinder your ability to invest in growth opportunities, acquire new equipment, or expand your operations, ultimately limiting your business’s potential for success.

Ignoring debt can also lead to legal consequences. Creditors may resort to legal action in order to collect what is owed to them. This can result in costly litigation fees, damaged relationships with clients, and even the seizure of assets or bankruptcy. Such legal battles can be detrimental to your business’s reputation and may have long-lasting effects on its financial stability.

By taking quick action in debt management, B2B businesses can mitigate these consequences and secure their financial future. Working with a reputable collection agency, such as Debt Collectors International, can provide invaluable assistance in recovering outstanding debts. Their expertise in the automation industry ensures a tailored approach to debt collection, maximizing the chances of successful recovery while maintaining positive relationships with your clients.

Additionally, implementing effective debt management strategies and processes within your organization is crucial for minimizing debt aging. By closely monitoring your accounts receivable, addressing payment issues promptly, and setting clear credit terms, you can reduce the risk of debts becoming uncollectible or aging excessively. Acting quickly and proactively in debt management enables your business to maintain a healthy cash flow, preserve its creditworthiness, and seize growth opportunities.

In conclusion, ignoring debt can have severe consequences for B2B businesses. From damaging cash flow and creditworthiness to legal repercussions, the impact of neglecting debt can hinder your business’s growth and success. By recognizing the importance of debt management, acting quickly, and leveraging the expertise of professionals like InvoiceGuard,, B2B businesses can navigate the challenges of debt and secure a prosperous future. Take action now and protect your business from the detrimental consequences of ignoring debt. For more information, visit www.InvoiceGuardUSA.com or call 855-930-4343.