Debt Collection Newsletter

Expert insights, proven strategies, and timely updates on debt collection practices, laws, and tips for both creditors and debtors on our comprehensive newsletter.

In the fast-paced world of B2B business, cash flow constraints can pose significant challenges to the success and growth of your company. In this subchapter, we will explore the importance of understanding and managing cash flow constraints, and how it can impact your business’s overall financial health. Cash flow constraints occur when a company experiences a shortage of available cash to meet its financial obligations. This can lead to delayed payments, missed opportunities, and even potential bankruptcy. As a B2B business owner, CFO, CEO, Office Manager, Controller, or Accounts Receivable Department, it is crucial to be aware of the factors […]

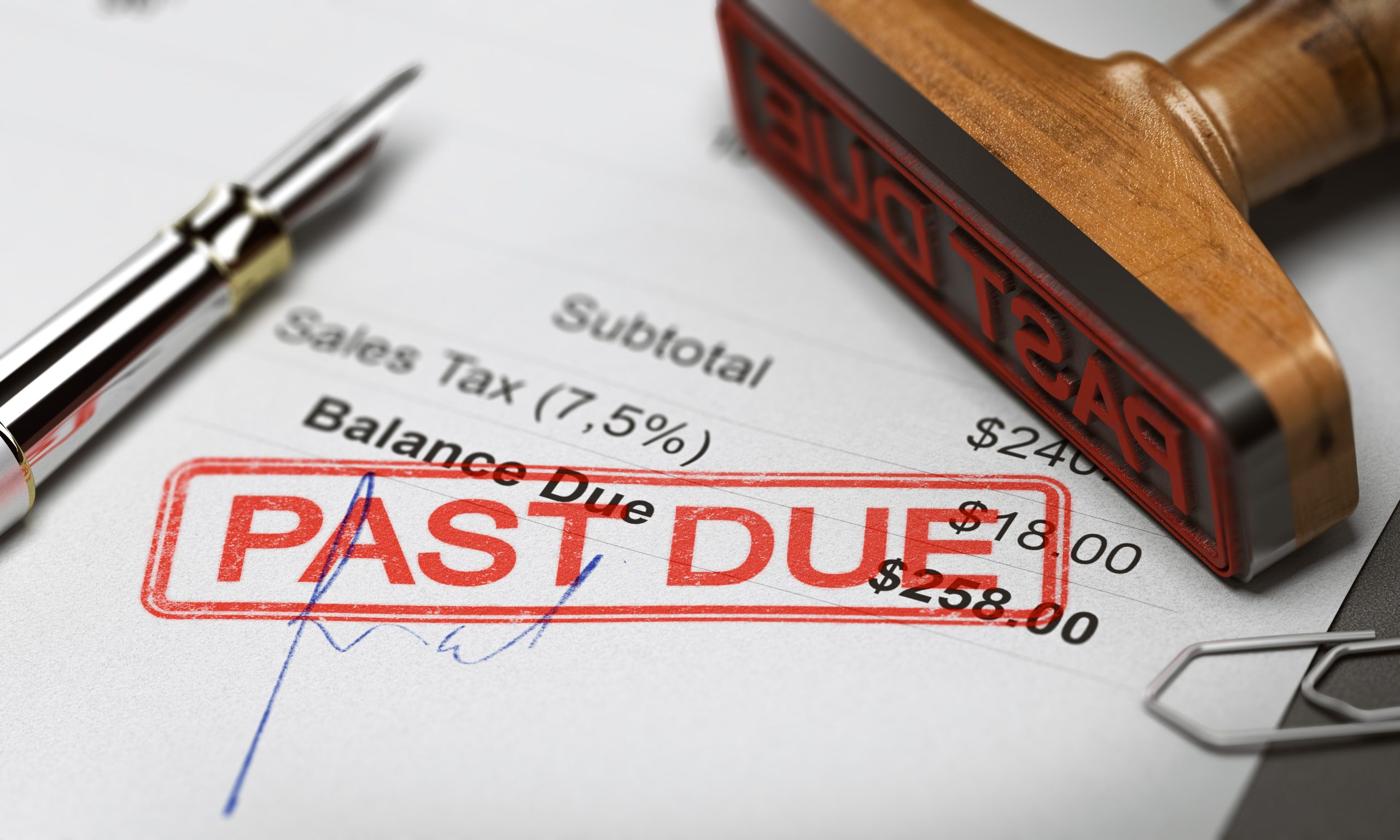

In the fast-paced world of B2B debt management, dispute resolution and effective collection efforts are vital for the success of your business. This subchapter will delve into the importance of resolving disputes quickly and efficiently, as well as the strategies and techniques that can be employed to maximize collection efforts. Resolving disputes in a timely manner is crucial for maintaining strong business relationships and ensuring prompt payment. When disputes arise, it is important to address them promptly and professionally. This can be achieved through open communication channels, active listening, and a willingness to find mutually beneficial solutions. By acting fast, […]

In the world of B2B business, managing debt is crucial for maintaining a healthy cash flow and ensuring the long-term success of your company. One of the key aspects of effective debt management is establishing clear payment terms and conditions with your clients. This subchapter will delve into the importance of payment terms and conditions, their impact on your business, and the value of acting quickly. Setting clear payment terms and conditions is essential for avoiding payment delays and disputes. By clearly stating the payment due dates, methods of payment, and penalties for late payments, you can minimize the risk […]

In the fast-paced world of business, it is not uncommon for B2B companies to face financial challenges and accumulate debts. However, ignoring these debts can have severe consequences that can negatively impact the success and growth of your business. TInvoiceGuard aims to shed light on the repercussions of neglecting debt and the importance of taking quick action in debt management for B2B businesses. One of the most significant consequences of ignoring debt is the strain it puts on your company’s cash flow. When debts remain unpaid, it can become increasingly difficult to meet your financial obligations, such as paying suppliers, […]