Why Invoice Guard’s Flat Rate System Stands Out

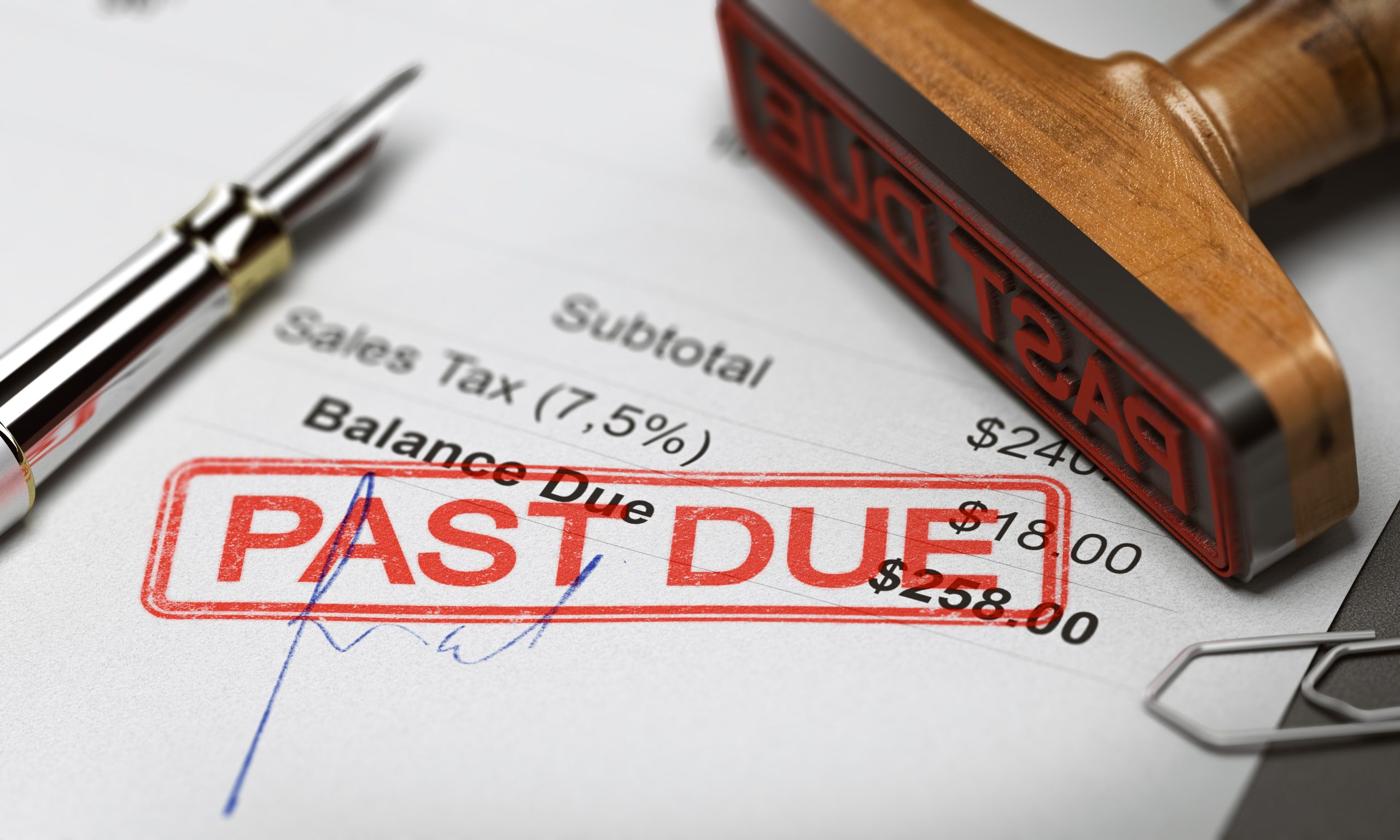

“The flat rate system encourages businesses to act promptly in submitting their debts for collections. By offering a competitive rate, Invoice Guard incentivizes businesses to take immediate action, reducing the risk of unpaid invoices piling up and affecting cash flow.”

Recovered funds remain with the business

Not only does the flat rate system offered by Invoice Guard provide businesses with cost savings, but it also ensures that the recovered funds remain with the business rather than being spent on exorbitant collection fees. By paying a fixed rate regardless of the amount of debt being collected, businesses can maximize their profitability and allocate the recovered funds towards growth and expansion initiatives

The flat rate system encourages businesses to act promptly in collecting their debts

With a lower fee structure, there is a greater incentive to pursue overdue payments and recover funds more efficiently. This ultimately leads to improved cash flow, increased profitability, and a stronger financial position.

“Don’t let unpaid invoices hinder your business growth any longer. Take control of your debt collection process and experience the efficiency and affordability of Invoice Guard’s Flat Rate System today.”

Flexibility

Invoice Guard’s flat rate system offers flexibility, accommodating businesses of all sizes. Whether you have a small operation or a large enterprise, the flat rate remains the same. This scalability ensures that you receive the same high-quality debt collection services, regardless of the size of your outstanding debts.

Fairness

Another aspect that sets Invoice Guard apart is its commitment to fairness. The flat rate system treats all clients equally, regardless of the size or nature of their business. Whether you are a small startup or a well-established corporation, everyone benefits from the same fair and transparent pricing structure. This fairness ensures that all businesses have equal opportunities to recover their debts without discrimination or bias.

Personalized Touch

Lastly, Invoice Guard’s flat rate system offers a personalized touch. The team at Invoice Guard takes the time to understand each business’s unique needs and tailors their collection strategies accordingly. This personalized approach increases the chances of successful debt recovery and fosters a positive relationship between the business and its debtors.

Steps to Integrate Invoice Guard’s Services into Your Business

Congratulations on making the smart choice of considering Invoice Guard’s services to streamline and optimize your debt collection practices. Integrating our services into your business can greatly improve your cash flow and ensure timely payments from your consumers. Below, we will guide you through the steps to seamlessly integrate Invoice Guard’s services into your business and reap the benefits of our innovative flat rate system.

Step 1: Understanding the Benefits of Invoice Guard

Before diving into the integration process, it is important to understand why Invoice Guard’s flat rate system is the smarter choice for your business. Unlike traditional agencies that charge a percentage of the total debt, Invoice Guard offers a monthly subscription of $150.00 per month for businesses to submit for collection up to $10,000.00 worth of outstanding debt EVERY MONTH.

Step 2: Assessing Your Business Needs

Evaluate your current debt collection practices and identify areas that need improvement. Determine the volume of your outstanding debts and estimate the potential cost savings by switching to Invoice Guard’s flat rate system. This assessment will help you understand the impact their services can have on your business.

Step 3: Contacting Invoice Guard

Reach out to Invoice Guard to initiate the integration process. Their experienced team will guide you through the necessary steps and provide personalized assistance to suit your business needs. They will address any queries you

may have and ensure a smooth transition.

Step 4: Providing Relevant Information

To effectively integrate their services, provide Invoice Guard with all the necessary information about your outstanding debts, debtors, and any relevant documentation. This will enable them to start the collection process promptly and ensure the best outcome for your business.

Step 5: Monitoring and Managing Collections

Once the integration is complete, you can sit back and relax while Invoice Guard takes care of your debt collection. Utilize their user-friendly platform to monitor the progress of collections, access detailed reports, and stay updated on the status of each debtor. This transparency allows you to maintain control over your collections while enjoying the benefits of Invoice Guard’s expertise.

In conclusion, integrating Invoice Guard’s services into your business is a wise decision that can revolutionize your debt collection practices. Our flat rate system offers significant cost savings compared to the industry average, and the straightforward pricing structure ensures transparency and peace of mind. By following these simple steps, you can seamlessly incorporate Invoice Guard’s services into your business and experience the transformative power of our debt collection solutions.

Enroll Now And Start Protecting Your Business

Why Invoice Guard’s Flat Rate System Stands Out

By opting for Invoice Guard’s Flat Rate System, you not only benefit from significant cost savings but also enjoy various advantages over traditional debt collection methods. Let’s explore a few key reasons why the flat rate system

is the smart choice for your business.

the cost savings and advantages offered by the Flat Rate System from Invoice Guard make it the smart choice for any business owner. By eliminating the uncertainty and excessive commissions associated with traditional debt collection

agencies, you can focus on growing your business while leaving the debt recovery process in capable hands. Don’t let outstanding debts hinder your financial success – opt for Invoice Guard’s Flat Rate System and experience the efficiency,

transparency, and cost-effectiveness it brings to your debt collection efforts.

With the flat rate system, you have complete visibility into your debt collection expenses. No more surprises or hefty commissions eating into your recovered funds. You pay a fixed monthly subscription, and you can accurately forecast your costs, making budgeting and financial planning easier.

Invoice Guard’s flat rate system encourages faster and more efficient debt collection. By removing the financial incentive to prolong the collection process, the agency is motivated to recover your debts promptly. This leads to higher recovery rates for your business, ultimately improving your cash flow.

With a flat rate system, the complexities of debt collection are simplified. You don’t have to navigate through intricate fee structures, multiple commission rates, or confusing calculations. Invoice Guard’s pricing structure is straightforward and easy to understand, ensuring a hassle-free experience for your business.

Invoice Guard recognizes that every business has unique debt collection needs. As such, they offer customizable solutions tailored to your specific requirements. Whether you have a small volume of debts or a larger portfolio, their flat rate system can be adapted to suit your business size and volume.

What Makes Invoice Guard The Only Sensible Choice For Debt Collections

Firstly

it provides transparency and predictability. With a flat rate, you know exactly how much you will be paying, regardless of the amount collected. This allows for better budgeting and financial planning, freeing up resources for other important aspects of your business.

Secondly

the flat rate system incentivizes efficiency. Since we charge a fixed rate, we have every motivation to collect debts promptly and effectively. Our team of experienced professionals is dedicated to achieving the highest recovery rates possible, ensuring that you get the most out of your debt collection efforts.

Lastly

the flat rate system promotes fairness. Regardless of the size of the debt, you will be charged the same flat rate percentage. This means that small businesses with lower-value debts receive the same level of service as larger businesses with higher-value debts. We believe in providing equal opportunities for all our clients to recover their debts, regardless of their financial capacities.